If you read the news regularly, you wouldn’t be a stranger to the plethora of articles stating that the Australian Real Estate market is due for a massive crash (20-30%) in 2023. Much of the pessimistic analyses comes as a result of the rising interest rates happening globally, in the world’s bid to tame decade-high inflation rates.

As an analyst planning to finally dip my toes into the highly-revered housing market next year, I thought it prudent to actually look at the correlation (though we are definitely not going into deep statistical analysis here) between Australian Real Estate prices and interest rate increases. Additionally, I wanted to see whether house prices really did fall in the past when interest rates increased. Please note this was all written in the span of a six hours, so please spare any typos. (Did it as a challenge to myself 😂)

Table of Contents

Introduction to Interest Rates and their effect on the Australian Real Estate Market

What are interest rates and how do they work?

Before we dive in, don’t forget that this website is Finance for Noobs, and that the goal of my writing is to explain these complex financial questions to our wonderful newbie investors! As such, let us start with explaining what exactly the relationship between interest rates and real estate have.

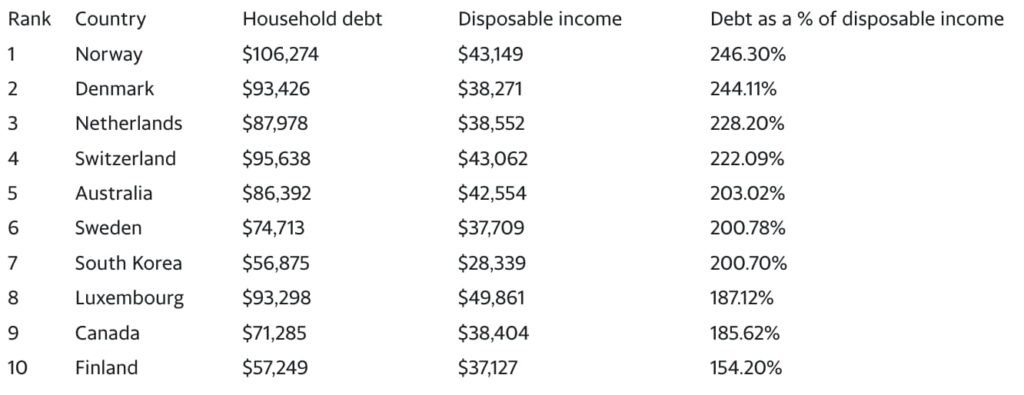

Australian households (unsurprisingly) have the fifth highest household debt in the world at approximately $86,000 worth of debt compared to their $42,000 of household disposable income. Additionally, the percentage of households’ total credit to the entire country’s GDP is at a staggering 120% – which effectively means that Australians have more debt in total than Australia’s annual economic output (a very rough explanation, but this is what it means in short)! Australians are in a crazy amount of debt – much thanks to our equally crazy real estate market!

Now, if you have any taken any line of credit/debt (e.g. credit cards, personal loans, mortgage loans, car loans), you would know that all of them come with interest payments. Interest exists because of inflation – your money losing value over time (e.g. that $1 meal you used to have 20 years ago is now worth $10) – banks wouldn’t lend you money for free if their money is going to be worth less when you pay it back!

Interest payments are then based on a set interest rate – this rate is generally based on the Reserve Bank’s (RBA) cash rate. At an annual interest rate of 3% for example, you would be paying $30,000 in interest payments a year for a $1M loan.

What is the effect of an interest rate increase on a mortgage?

As such, when the Reserve Bank hikes interest rates, banks and mortgage lenders also subsequently increase their rates. For those with mortgages, this means that your repayments will be higher (e.g. your rate going from 3% to 4% on a $1M loan would mean you are paying $40,000 a year now on interest payments).

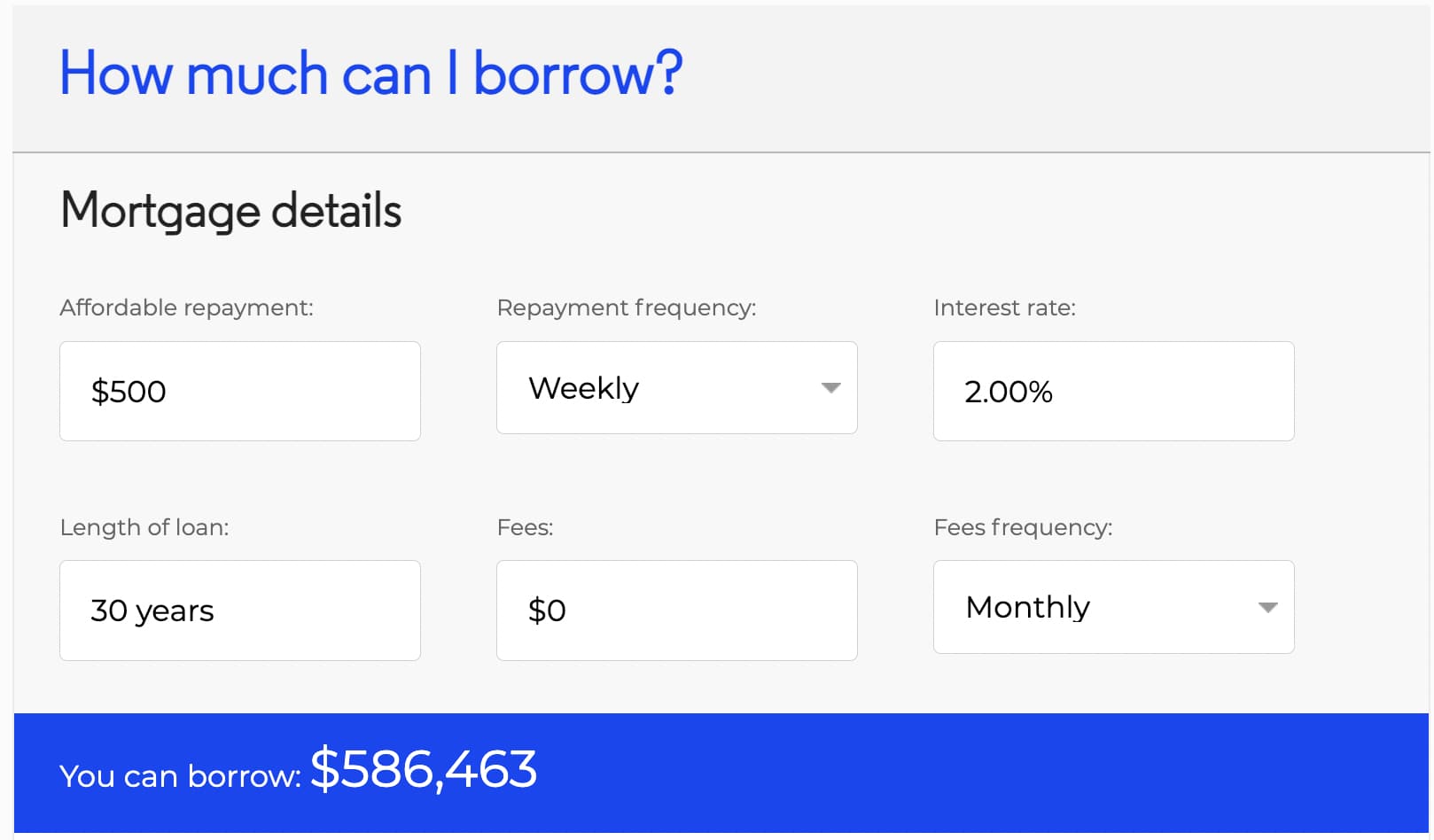

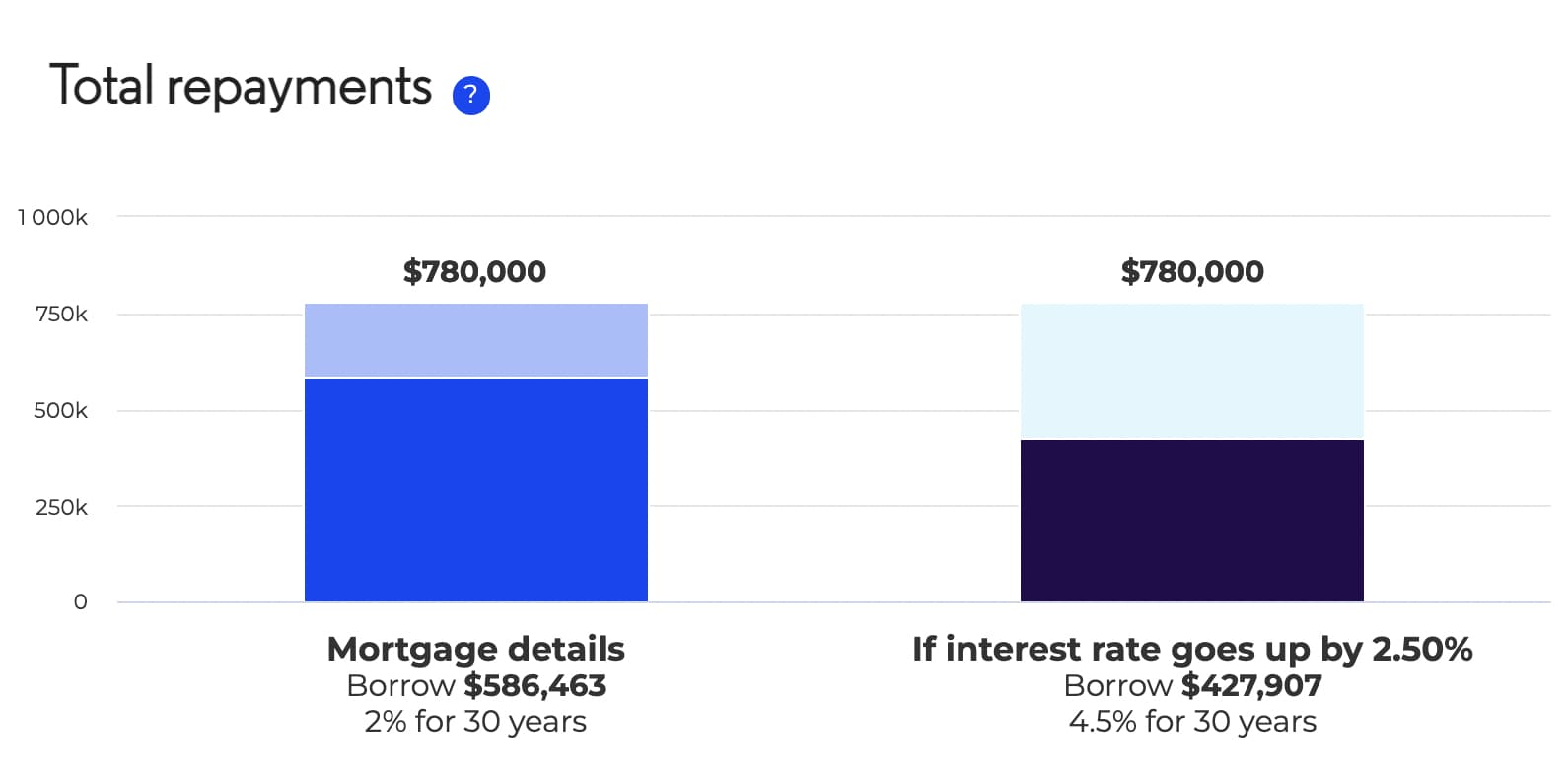

And for those without a mortgage YET (who pays for Australian real estate in cash? 😭), you will find that you can borrow less due to the higher rate. This is because the bank calculates your borrowing capacity based on how much you can repay.

To provide a very rough illustration, if you can only afford interest payments of $30,000 a year (e.g. 3% of a $1M loan), if the interest rate is increases to 4%, you can now only borrow $750,000 – 4% of $750,000 is $30,000; with your repayment capacity still at $30,000, a higher interest rate will mean you can no longer borrow that $1M.

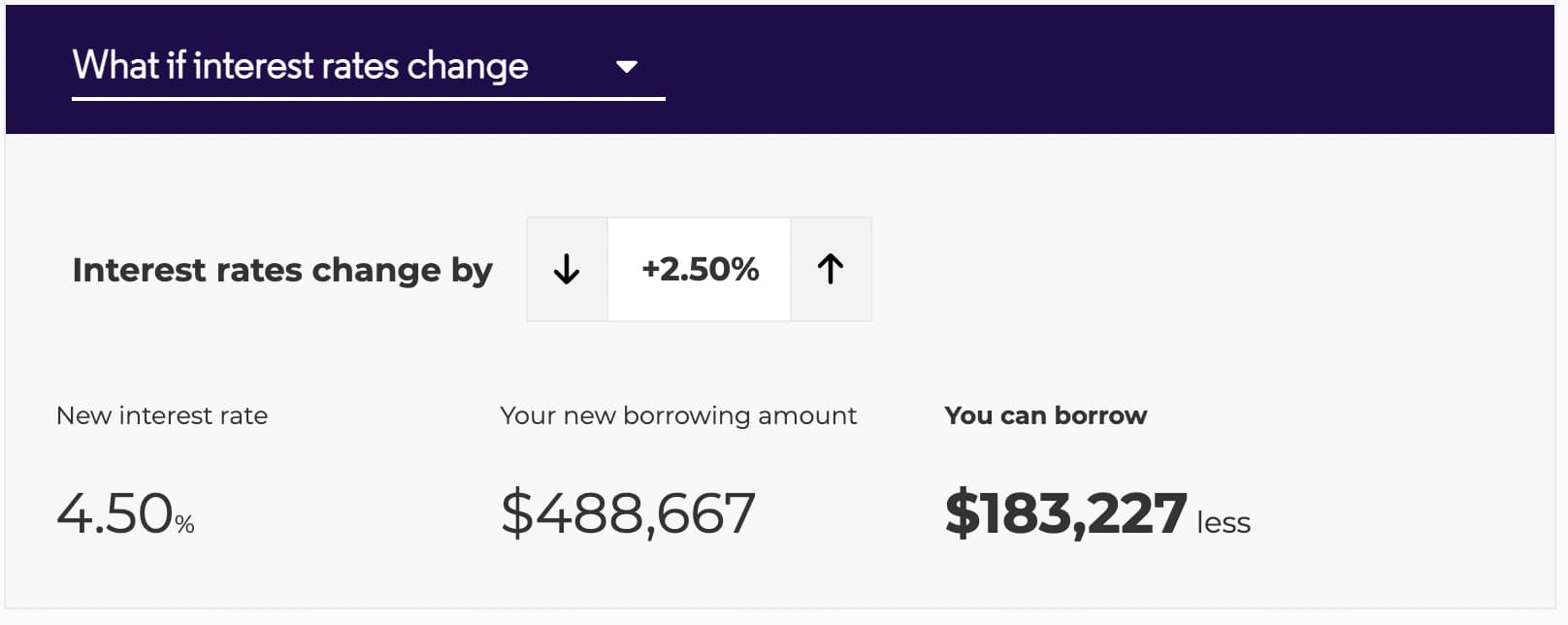

Note: While the calculations of your borrowing capacity is more complex in real life, hopefully these examples help you get the gist of how an interest rate increase affects your mortgage. If you would like to play around with calculations, I would recommend the government’s very own mortgage and repayments calculator. Example below.

With Australians being one of the most indebted people in the world, how many people do you think would struggle with higher interest payments? 😨

What is the effect of interest rate increases on the Australian Real Estate market?

Now that you know how interest rates work and how they affect people’s mortgages and borrowing capacities, do you have any guesses as to how this actually affects the housing market as a whole? 🤔 You probably do (because I believe in you!), but I shall still explain a little bit just to ease any doubts.

Firstly, remember that an interest rate hike affects not just mortgage interest rates, but all the lines of credit that a lender has. Higher debt repayments would mean that people who have any form of debt will be seeing less money in their savings accounts after their periodical repayments. People who are very highly leveraged (fancy way of saying that they are very much in debt 😶🌫️) are especially prone to this.

If interest rates increase a lot – in Australia, the rate has already increased by a staggering 2.5% from the start of 2022 – people will soon start to become unable to pay off all their loans. In effect, some people may be forced to sell their properties. So far, we have already started seeing this phenomenon in the capital cities where house prices are insanely high.

Additionally, people who haven’t gotten mortgages yet will see their borrowing capacity drop by a fair bit. This means that real estate, particularly pricier ones, will see less potential buyers.

With people selling more properties due to higher interest payments, and less buyers in the market, do you see what’s going to happen? Yes, most likely dropping real estate prices, as housing supply outstrips demand.

A look into the past: Historical relationship between the RBA’s interest rate and the Australia’s Real Estate market 👀

SO, now that we’ve finally gone through that lengthy intro-to-interest-rates-for-noobs, let us finally move on to the main point of this article. Do note that this part will have a few graphs, and might be a bit confusing as it’s more a more advanced topic.

The question we are trying to answer: Will house prices really fall next year?

To start with, analysts and economists from Australia’s major financial institutions predict real estate prices to fall between 10% (RBA forecast) to 20% (ANZ) in the next few quarters due to the rising interest rates. Some retail investors even believe a 30% crash in the following year.

Slowing growth in Australian real estate prices

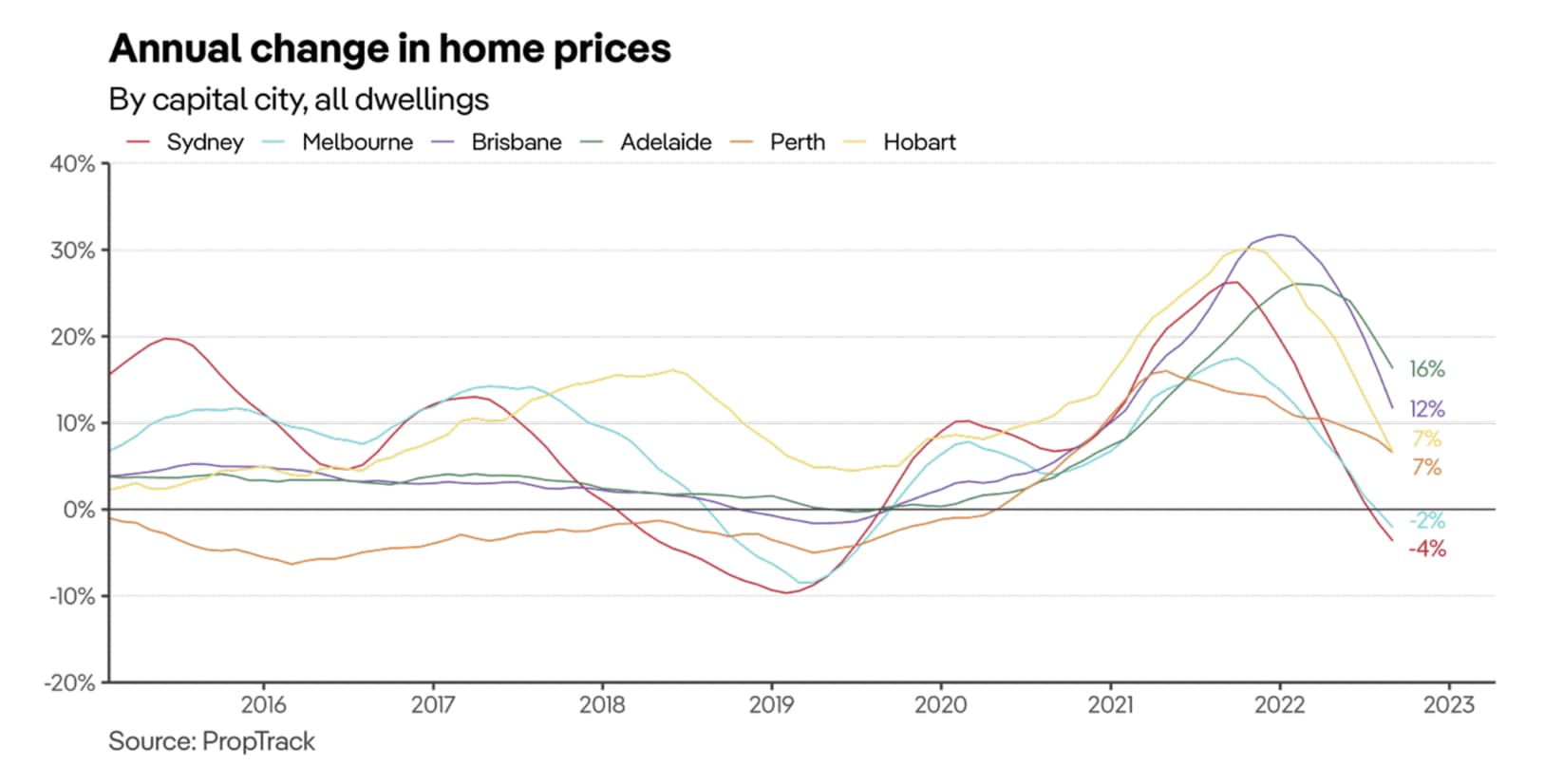

Now, according to Proptrack, a subsidiary of the REA group (who owns realestate.com.au), the growth in house prices has already begun slowing down this year:

Before anything, do note that this is a graph in the annual change in house prices (i.e. year-on-year house prices) and not the actual change in median house value – as such, as long as the lines below remain above 0, house prices are still higher than the year before.

At first glance, home price growth for Sydney and Melbourne began dropping as early as late-2021 – well before the first RBA rate hike in May of 2022. Mid-2022 finally saw growth rates go into negative territory; which means that compared to the year before, house prices have gone down. This is also the latest data from Proptrack taken from its October 2022 report. With the forecasts for 2023 being a drop of 10-20%, Sydney and Melbourne’s 4% and 2% YoY drop seems to still be a far cry.

Similarly, other capital cities experienced their growth rate peaks between 2021-2022. The growth in house prices have slowed down, however, none of the other capital cities have yet to actually experience declining house prices. Similar to Sydney and Melbourne however, growth in the house prices had slowed down prior to the first rate hike.

Changes in the RBA cash rate vs. Real residential property prices

Now, recall that the big banks and the RBA both think that house prices will fall 10-20% next year due to interest rate increases.

Let us examine this.

In order to see the effect that interest rates have on house prices, look at the nifty little graph I made that combines the first two on inflation-adjusted house prices and the RBA’s cash rate:

Before:

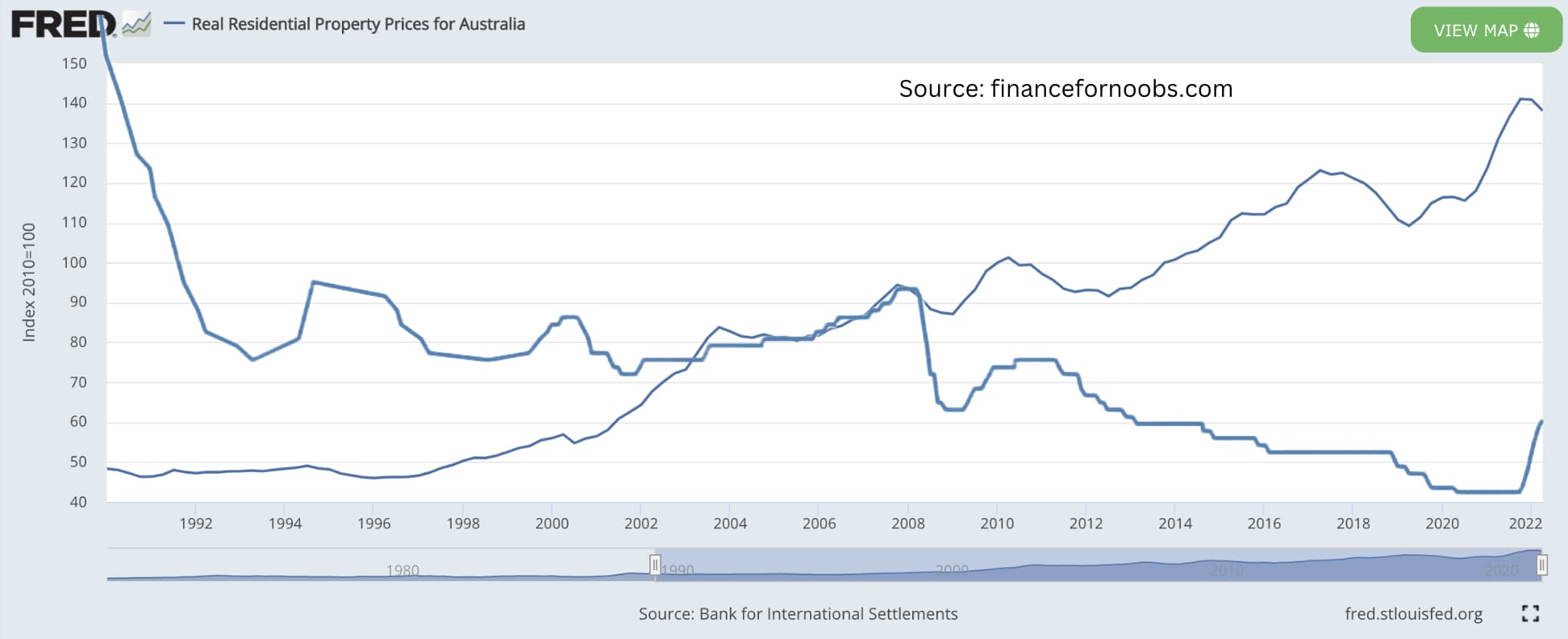

This is the graph for the Real Residential Property Prices. Real means the property prices are adjusted for inflation. An index aggregates the data of the property prices and makes it easy for us to see the movement in prices. Think S&P 500 index.

With my magic:

Unfortunately I couldn’t change the colour of the lines, so just take note that the thicker line is the RBA’s interest rate graph.

Now, let’s add some arrows:

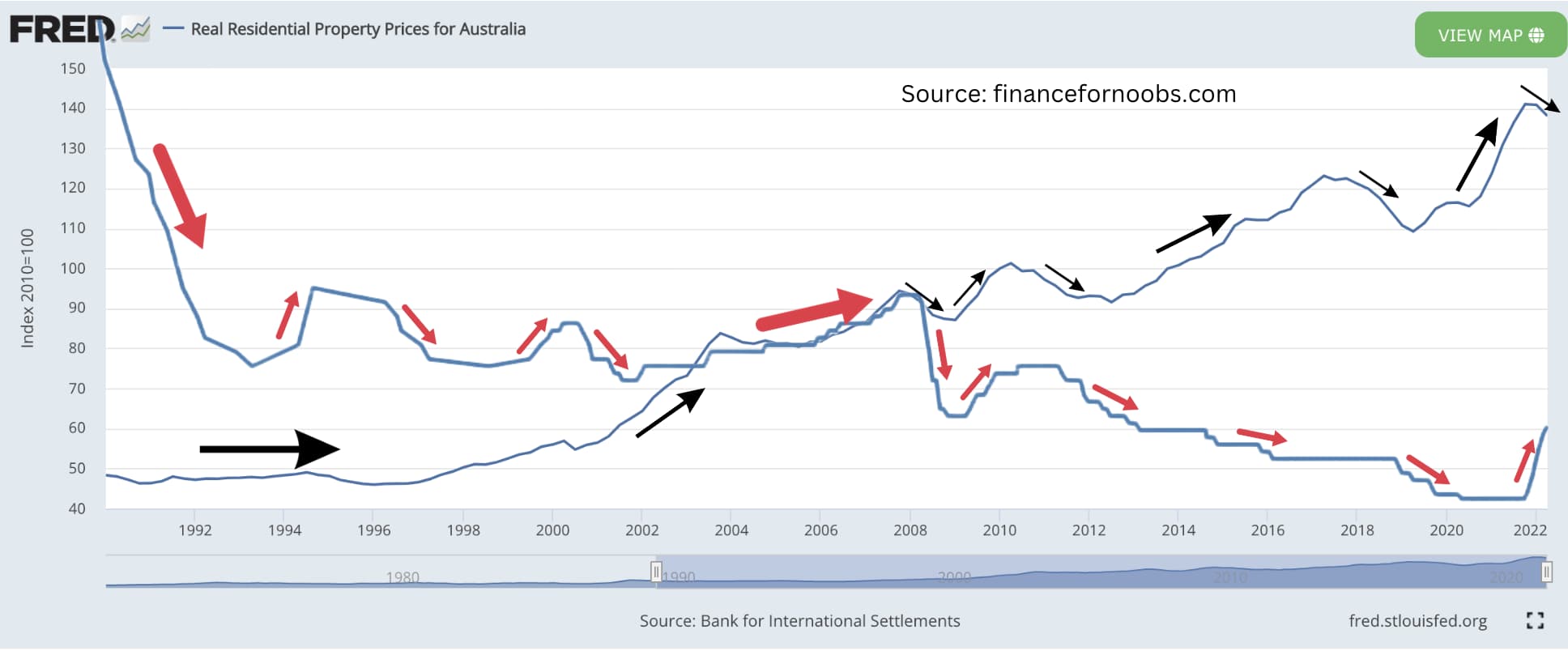

I have masterfully combined the two graphs (you are welcome heh), and also added arrows for you to see the movements of the graph. The red arrows refer to the movement of the RBA’s interest rate, while the black arrows refer to the movement in inflation-adjusted house prices.

Now that I’ve made this all easy on the eyes, let’s take a closer look. We are trying to see whether interest rate increases/decreases actually lead to decreases/increases in house prices. The argument is that they are inversely-related.

Back between 1990 to 1994, the RBA’s interest rate took a steep decline – going from about 18% to just 5%. During this time, contrary to our expectations, inflation-adjusted house prices BARELY moved, if any. Given the much lower interest rates, you would’ve thought that the demand for houses would have gone up as more people could afford mortgages and had higher borrowing capacity.

Additionally, the period between 2002 to 2008 saw interest rates increasing – but real estate prices ALSO INCREASED. In fact, at the beginning of the interest rate decrease in 2008, house prices ALSO decreased; however, this could arguably be because of people experiencing fear from the global financial crisis.

So far, it seems like interest rate changes haven’t actually inversely affected house prices.

As we continue along the graph, interest rates have steadily gone down as the country goes into expansionary mode (or cheaper credit) in order to grow the economy after the wake of the GFC. Rates were increased a teeny bit in 2010 (about 1.5%), and you can see house prices fall slightly in the next few years (2011-2012). We can finally see an inverse relationship between the interest rate and property prices here – and it continues on for a few more years as the RBA rate continues to fall. However, upon reaching 2017, house prices fell quite a bit when the RBA’s cash rate remained stagnant.

Will house prices go down in 2023? The verdict.

I can definitely see some semblance of an inverse relationship between the interest rate and house prices – however, I don’t think interest rates have as much effect on house prices as all the recent news make it out to be.

Sure, in the span of 30+ years (1990-2022) the interest rate had gone from about 18% to 2.35%, and long-term house prices over those 30 years had also tripled. However, if we are looking at house prices falling 20-30% by 2023, as some estimates have it, I would say that based on history, this is unlikely to happen. 10% may be probable though.

Additionally, this would most likely only be a short-term drop in real estate prices (few months to 2 years). The interest rate as it is now (2-3%), is a far cry from the previously double digit interest rates our parents had to endure. Not only that, Australia’s government looovvveeesss real estate! Look at the number of subsidies and first home buyer grants available – too many to prevent a massive plunge in house prices! Banks will also do all they can to prevent a foreclosure; we have interest-only repayments, refinancing, their ability to offer you a lower interest rate if you ask, and so on.

Hope this article was insightful! This is my first analysis into the property market, so please do let me know what you think. Also, please do have a read of my other articles. My story on Qantas Points seems to be the most popular!

4 Comments

Interesting Read! 😊

Pingback: How to Buy a House with No Deposit - 15 Q&As with an Expert 🏠 » Finance for Noobs

Everyone loves it when folks get together and share thoughts.

Great blog, continue the good work!

A greаt material thаt is weⅼl-madе.