A wish everyone in the world has – if only there was a way we could buy a house with no deposit!

Well, luckily, you have inquisitive little me 😉

A few days ago, I was fortunate enough to have the opportunity to have a short Q&A with a mortgage broker from one of the largest financial institutions in Australia.

As someone closely following the Australian property market, we talked a little bit about how it was all going in Sydney (where both the mortgage broker and I are based in), especially with interest rates continuing to increase.

However, the cherry on top was when I was able to get some great tips for first home buyers; the process of buying a home in Australia, common questions, first home buyer tips, and most importantly, finding out that buying a house with no deposit is actually possible (and how to do it!).

Disclaimer: Please note that the information on this article is not meant to constitute financial advice; it does not take into account your objectives, financial situation, and needs. Consider seeking independent legal, financial, taxation or other advice to check how the information on this blog relates to your unique circumstances. Additionally, this isn’t a full transcript of what we talked about, and the Q&A had been edited for better reading.

Table of Contents

-

So with all the talks on higher interest rates and higher mortgage repayments, what’s the mortgage lending market looking like?

We’re noticing a slowing of the lending applications, and an increase in lending applications that are declined due to a reduced borrowing power for applications as repayments go up.

2. How much has your lending activity has slowed down? Doesn’t have to be for your entire business, but just for yourself.

Personally, I’ve received about 50% less applications compared to last year.

3. Have home prices definitely gone down, as what the media says?

Depending on the area, we have definitely seen a decline in property prices when completing valuations, as compared to earlier this year. Generally, you’ll find this in expensive areas and high density places such as in Rhodes where home prices went through the roof in 2021.

4. Have you actually received any notices of foreclosure?

Unfortunately I don’t deal with them directly – so I have no idea.

FAQ for first home buyers in Australia

5. Do you get a lot of first home buyers? What are their demographics and what kind of property do they usually aim to buy?

Yeah, I do. I’d say most of my clients are first home buyers.

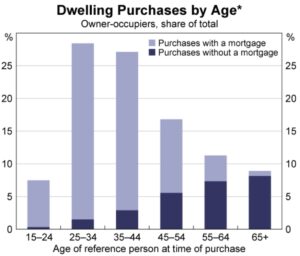

Generally, they’re in their late 20s to early 30s, professional couples, most of them receive help from parents in the form of a deposit. The types of properties they’ve been looking at have been getting smaller, as their borrowing capacities have been getting impacted by the rate hikes. They mostly aim to buy PPORs (principal place of residence), usually in Western Sydney where prices are lower.

6. Has there been a slowdown in the number of first home buyers you’ve received?

Definitely, people are worried about the increasing repayments.

7. For all our first home buyers in Australia, what is the process required to buy a home?

The first step is to get a pre-approval for your borrowing capacity with your mortgage lender (author’s note: next section). This will give you a limit of how much you can buy. The next step is to, of course, find a property – do your research, find the right one for your needs. Before offering to purchase or going to auction, make sure you get a building and pest inspection done.

You should also request a copy of the contract of sale for the property before making an offer, and have your solicitor go through it to ensure there are no red flags. Additionally, if the sellers are unable to provide a contract, that is a definite red flag.

After all that, you can make an offer. If the offer is accepted, you sign the contract, and pay the sellers a deposit – normally 10%, but some might accept 5%, and some may accept deposit bonds. Normally, there’s a 7-day cooling off period to retract your offer; there may be some fees incurred, but you won’t lose your entire deposit.

At this point, your bank would then conduct a valuation on the property, asking for any documents they might need from yourself such as property insurance. This is normally the most stressful time for first home buyers due to anxiety and nerves, however it’s during this time that your solicitors, the vendor’s solicitors and the bank will be doing all the work. Most of the time, you can just sit back and wait for the settlement of the property.

On the day of settlement, you will be given your mortgage, the vendor will be given their money, and they should give you the keys to your new home. Congratulations!

8. What does a pre-approval with your mortgage lender mean?

A pre-approval just means that you have your borrowing capacity evaluated to see how much your maximum mortgage can be.

Evaluating your pre-approval would require filling out an application form with the bank, for the bank to determine your assets, liabilities, and living expenses. If you’re not self-employed, you would just need to provide recent payslips and statements of liabilities (e.g. credit card statements or personal loans). Some banks are stricter and even require further documentation such as tax returns and notices of assessment from the ATO.

An important thing to note is that a pre-approval is not a commitment from the lender/bank to lend you this amount of money – it is simply an indication of what they can give you if all conditions they have are met (e.g. property value and credit checks).

9. Do you have any tips and tricks first home buyers can do to be able to own a property earlier?

Make sure you try to avoid personal debt as much as possible, such as credit cards and personal loans that massively affect your borrowing power. If you’re looking to buy an apartment, buy in a low-rise or smaller block – banks are less likely to lend you the amount you need with a big block. They usually require a higher deposit of up to 40% for those, and some might even get declined for those.

10. Why are banks less likely to lend for bigger apartment blocks?

It’s just because those properties are a higher risk to the bank, valuation-wise. Properties in bigger apartment blocks and high-rise buildings tend to not go up in value much, which could lead to a loss for the bank if you foreclose.

11. If banks are less likely to lend for bigger apartment blocks, are there also houses or types of houses that banks are hesitant to lend to?

Yes, generally this is for homes in regional areas, especially farmland. Depending on the postcode you are looking to buy in, your property might be considered “rural”. You can still buy it, banks would just require you to have a bigger deposit – about 40% or sometimes even more.

Author’s note: Some extra information I got was that lenders have a list of postcodes that would require a higher deposit. Different banks/lenders could have a different list – so it could be good to shop around different banks.

12. Is there any way someone can buy a house with no deposit at all?

Actually, yes. But you will require the bank of mum and dad to be on board. 👪

A big one is that if you don’t have enough for a home deposit, but someone in your family is willing to help, they can offer a portion of their property as security for your deposit (more info in the next section).

This way, you don’t actually need cash upfront, and can borrow 100% of the value of your property, plus stamp duty – provided that your income can service the total loan you need and there’s enough equity in your family’s property. This is called cross-collateralizing using a family guarantor.

As previously mentioned, sellers of a property also usually require a 5-10% deposit once they accept your offer to buy their house.

If you don’t have the cash for a deposit, you can opt to take out a deposit bond, which is used as evidence that the entire property purchase price will be given to them on settlement date. If the seller accepts the deposit bond, you won’t to pay the usual cash deposit.

Using a family guarantee and a deposit bond, you can buy a house with no deposit.

13. How does a family guarantee mortgage work?

Normally, a bank would require a minimum of 5-10% deposit. Anything below a 20% deposit would also mean you have to pay lender’s mortgage insurance (LMI), which can be tens of thousands of dollars.

This is where your family comes in. If they have enough equity in their property (which is calculated as 80% of their current property’s value minus existing mortgage amount), they can offer this equity as security/collateral to the lender for the property you want to purchase. This way, you can avoid LMI.

14. Can you give an example of a family guarantee?

Yes of course.

Let’s say Ben wants to buy a property worth $1,000,000. He has no savings, since he just started his career. However, Ben earns a large income, enough to service a loan that would cover $1M + stamp duty – he just does not want to have to wait till he has enough deposit for a house.

Fortunately for Ben, mum and dad are willing to help out. While they are unable to give him cash for a deposit, they own a beautiful home with a good amount of equity (again, calculated as 80% of their current property’s value minus existing mortgage amount).

Ben’s desired property: $1,000,000

Stamp duty on $1,000,000: $40,090

Required deposit to avoid LMI: 20% or $208,018, which means Ben’s loan-to-value ratio (LVR for short) must be 80%.

Mum and Dad’s property value: $1,200,000

Mum and Dad’s mortgage: $500,000

Available equity in their property calculated as: ($1,200,000 x 80%) – $500,000 = $460,000

Mum and Dad tell the bank that since Ben is borrowing 100% of his property’s value (i.e. $1M), in order for Ben to be able to purchase his home and skip on paying LMI, they can offer Ben’s 20% deposit to be secured/guaranteed by their home. Additionally, they can also secure a bit more for Ben to include the cost of stamp duty in his mortgage.

With stamp duty, Ben’s total loan amount will be roughly $1,040,090. Since Mum and Dad’s equity is $460,000, they are able to be guarantors for 20% of the loan value ($208,018).

Voila! Ben is buying a house with no deposit whatsoever – he only has to make sure he can afford the repayments on his $1,045,000 loan.

15. What are some common mistakes that first home buyers make?

If you are looking to buy a property, make sure you get a pre-approval beforehand, to ensure you can actually complete the purchase. Pre-approvals generally last 90 days, you can use this time to find your perfect property. I’ve seen many home buyers place a deposit on a property and seek pre-approval after. Turns out they couldn’t borrow enough to complete the purchase, and ended up losing their cash deposit.

And that concludes our interview with our wonderful mortgage broker!

Hope you were take away some important lessons. I’m personally looking to purchase my own PPOR next year as well, and will mostly use what I learned in this Q&A in order to buy my house with no deposit.

Please do share your story if you used any of the tips here!