Welcome to Part 2 of learning the easiest tax deductions for a higher tax return! If you haven’t yet, head onto part 1 first to learn about the tax deductions for clothing expenses and working from home. Additionally, if you have absolute ZERO knowledge on what tax deductions even mean, you MUST read my extremely easy guide on doing your own tax return!

Now that that’s over with, let’s continue on to getting a higher tax return 🥳

Disclaimer: Everything written here is general information taken from Australian taxation legislation for the purpose of education. Taxation is a complicated topic that usually requires examination on a case-to-case basis. If you are unsure of your circumstances, please visit a registered tax agent – their fee is tax-deductible!

Table of Contents

How to Maximize your Tax Deductions as an Employee Part 2 💰

3. Travel and Vehicle Expenses 🚗

Have a car that you use for work? Well, you are very welcome, because you might find that you could actually get your car expenses (yes, including gas, rego and insurance?!) as a deduction! Additionally, if you use other modes of transportation that you pay for such as ubers, you could potentially claim the costs of those as well.

How do I claim my Vehicle expenses?!

Yes, exciting topic isn’t it? 🥳

First of all, let me clarify that you can actually claim vehicle expenses for the following:

- A car you own, hire, or lease

- Someone else’s car you use

- A vehicle that isn’t a car

Each of the above will have a different process for calculating your tax deduction. As much as I would like to go into each one, it would make this article way too long! As such, we’ll only be talking about #1 – tax deductions for a car you own, hire, or lease.

Car expenses you CAN claim

So naturally, the ATO won’t allow to just claim ALL your car expenses – they gotta make some monies too! However, I am here to give you an easy handy-dandy list of expenses that they consider eligible as a tax deduction, plus some examples listed in the bullet points:

You use your car for:

-

Work-related duties.

- Traveling from work to another place to meet a client;

- Driving from the office to the stores to buy stationary for work;

- Driving to pick up a work client from the airport;

-

Driving to work-related conferences/meetings away from where you usually work (where you usually work can either be your office or home if you work from home).

- Your company decides to hold a press conference in the convention centre and you are required to come in.

-

To collect/deliver items for work.

- Working as a Deliveroo driver and you deliver food for work.

-

Traveling between 2 or more separate places of employment; excludes traveling from home to work.

- Driving from your first job to your second job/your third job/your fourth job (look at your Mr/Ms Moneybags!).

-

You drive from your usual place of work to another place of work, and then back to your main place of work/home.

- Driving from your main company office in Bondi to the other company office in Sydney CBD;

- Working in customer service and used your car to drive to another branch of the company to help out;

- … and don’t forget to include the trip back to the main office/branch you work at;

- … or if you don’t go back to your main office/branch, the trip back home is tax deductible.

-

Traveling between your usual place of work (or home if you work from home) to another place for the purposes of work.

- Such as visiting a client’s office;

- or visiting the company warehouse.

Travel between work and home can also be a tax deduction in these circumstances:

-

Your company requires you to start work at home and then later travel to another workplace to continue the same work.

- Such as being a mobile home lender who mainly works from home but travels into an office to meet clients.

-

You have no fixed place of work and have to continually travel from one work site to another.

- Such as being a property valuer who travels to different properties to do the job.

-

You can also claim your travel between home and work if you carry bulky tools/equipment in your vehicle – and: there is no storage for it at work; the items are too bulky that you require your vehicle to transport them; and the items are NECESSARY for you to perform your job.

- You work for a lawn mowing company and are required to take your lawn mower to every job site.

- You are a freelance photographer working under an agency and have to take your equipment around with you.

That’s pretty much it for the car expenses you are allowed to claim as tax deductions. Now for the lame part, let’s move on to the vehicle expenses you cannot claim for.

Car expenses you CANNOT claim 🙅♀️

Generally, you cannot claim normal travel between your home and your workplace – even if you live far from home, or have to work outside of your normal business hours. The only times you are able to claim for vehicle expenses are the ones in the previous section.

You also cannot claim expenses for your car if:

- You pay for your car under a salary sacrifice agreement with your employer (this is because salary sacrifice is taken from pre-tax income).

- Your employer reimburses you for your expenses (your employers claims it as their tax deduction instead!).

And those are pretty much it! Isn’t it great that you have more situations where you can claim than when you can’t? 🥳

How to calculate your total tax deduction for car expenses

The ATO has provided 2 methods you can use to calculate your deduction:

- Cents per kilometer method

- As the name says, your tax deduction is calculated by a set rate (78c for 2022-2023) per kilometer of work-related car use.

- You can use this calculator by the ATO to calculate.

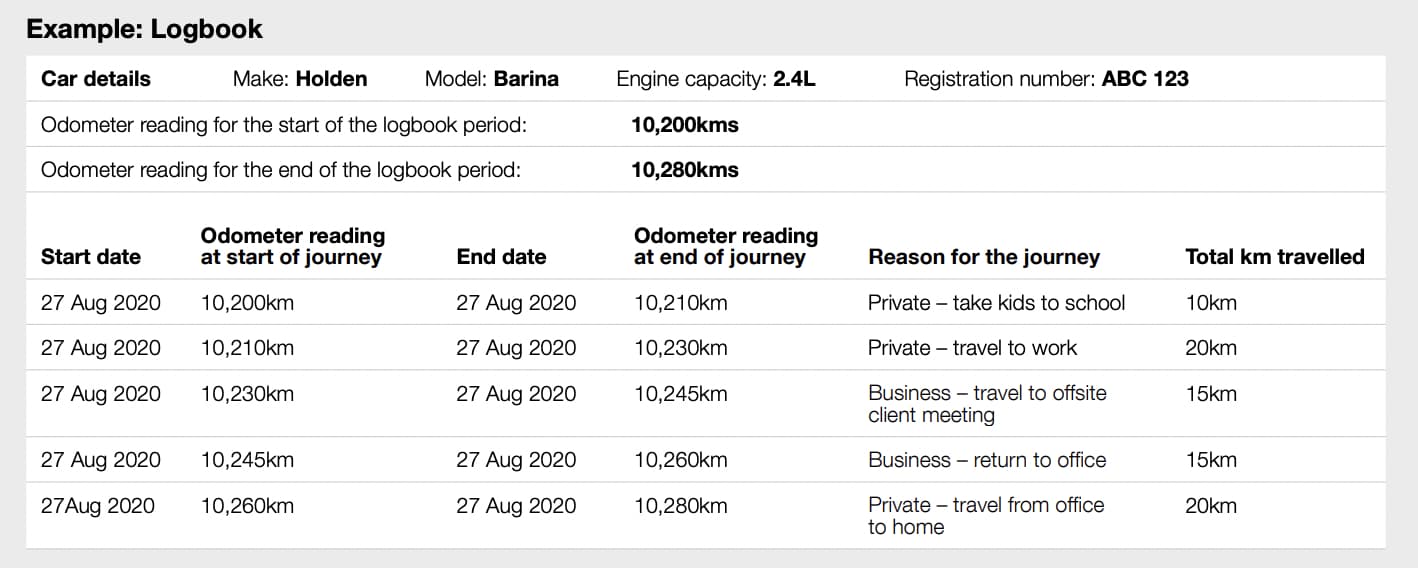

- Logbook method

- This one is more challenging to do but more thorough. You are required to keep a logbook for each car, with a minimum of 12 continuous weeks of work-related car expenses in order for you to claim a deduction.

- You must keep records of your odometer readings for each work-related drive you do, as well as receipts for your fuel and oil costs.

- Based on the odometer readings, you can claim the percentage of your running costs (e.g. rego, insurance, service) and depreciation expense (ATO will usually help calculate that) as a tax deduction.

4. Self-education Expenses 📖

Yes, you can claim your education and study expenses – if they relate to your employment activities!

I have personally made use of this tax deduction for when I took the effort to study Financial Reporting for the CPA exam. The entire course costed me over $1,000, but I was able to claim a part of it back because it related to my job at the time I took it. Unfortunately as I transitioned to a role in investments and writing, I can no longer take the CPA exam and still claim the costs.

Let me outline to you what is required, and how you can be eligible to claim self-education expenses.

Eligibility to claim for self-education expenses

You can only claim them as tax deductions if:

- You spent the money on the course yourself and wasn’t reimbursed by your company,

- It must directly relate to earning your income:

- ✅ The course is connected to the work you currently/were undertaking at the time you took the course;

- ✅ It maintains or improves specific skills and knowledge you require in your current work activities;

- ✅ results in – or likely to result in – an increase in your income from your current work activities;

- ❌ You cannot claim if it relates only in a general way to your current employment/profession (e.g. studying photography while working in a retail shop as an assistant)

- ❌ You cannot claim if it enables you to get new employment with different work activities (e.g. current nurse studying to be a doctor)

- You must have records to prove it.

Eligibility when you work while studying

The ATO has given additional circumstances where you can claim for your self-education expenses when you are employed and working while studying.

For myself for example, studying the CPA while working in an accounting job qualified under this.

If you work while studying, are eligible under the previous section’s eligibility criteria, and can satisfy any of the below conditions, you can claim tax deductions for your education expenses:

- Upgrading qualifications for your current employment – e.g. Bachelor’s to Master’s

- Improving specific skills and knowledge you use in your current employment – e.g. my case

- You’re a trainee/apprentice and the course you are taking forms part of that trainee/apprenticeship – e.g. doing a diploma in hairdressing when working as an apprentice hairdresser

- You can show that at the time you were working and studying, your education would/is likely to lead to an increase in income – e.g. automatic pay increase once you complete a course

As such, it definitely looks like you should be working before you start studying to get the most of your tax deductions! 😂

What education expenses you can claim

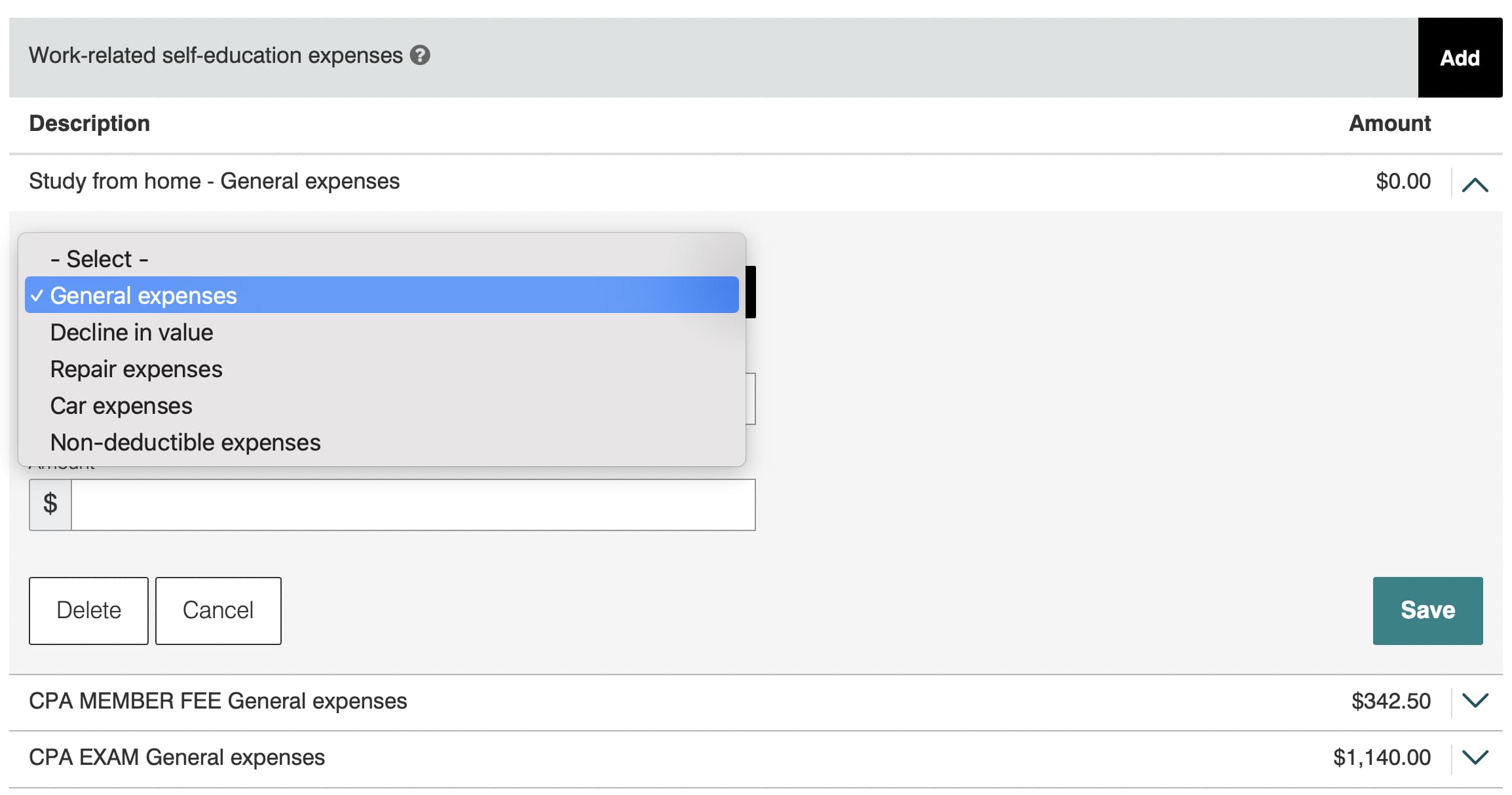

So, now that you are eligible (hopefully!) for tax deductions on your education, let me show you a list of the different expenses you can claim for 🥳

1. General Course Expenses

Pretty much everything you incur while you are studying:

- Course and tuition fees (WOOHOO!)

- Equipment or technical instruments ($300 and below)

- Accommodation and meals (e.g. when you course requires you to be away from home for one or more nights)

- Internet and data usage

- Textbooks

- Student services and amenities fees

- Trade, professional, and academic journals

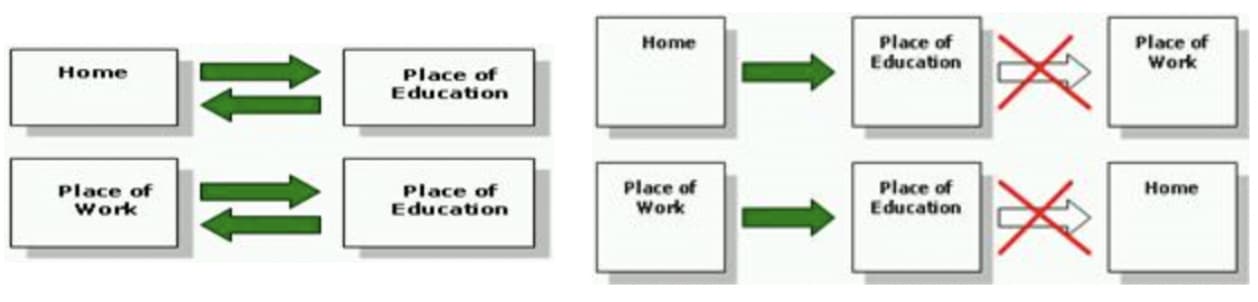

- VEHICLE/TRAVEL EXPENSES

- Yes, between your home/workplace to your place of education!

- Calculated the same way as the previous section!

- Stationary and computer consumables

- Home study expenses if you studied at home (similar to WFH expenses in part 1)

- So many more tax deductions! Too long to list.

Image from the ATO. Wonder when it was made? 🤣

2. Depreciating Assets

Government really supports self-education!

You can claim depreciating assets you use for your studies (e.g. computers, desk, printers):

- Full cost ($300 or less) if you mainly used the asset for studies.

- Decline in value (there is a calculator available on your tax return lodgement form to do it) for items valued $300 or more; and proportionate to your amount of use for self-education and private use.

3. Financing Expenses

These are also under “General Expenses”, but I just thought to explain it further in this article.

If you took out loans to pay for your education, you can claim interest on the loan as tax deductions as well!

Additionally, you can claim the fees payable on your study and training support loans (e.g. FEE-HELP or VET student loan) – but note that it’s only the fees that can be tax deductions, not the repayments on the actual loan.

As you can see in the image by the way, the last option is “non-deductible expenses”. That one is a bit arduous to explain, so please just refer to the ATO’s page on it.

Education expenses you CAN’T claim

Now for the lame part, here are the things you are unable to claim are tax deductions:

- Tuition fees paid for by someone else or if somebody (employer or third-party) has reimbursed you

- Student contribution amounts

- Repayments on study support loans (e.g. HECS, FEE-HELP, ABSTUDY, etc.)

- Work-from-home occupancy expenses (e.g. rent, mortgage, interest payments)

- Accommodation and meals associated with day-to-day living (imagine if you could claim your life expenses as tax deductions?! 🤣)

Conclusion

To be honest, the calculation for the tax deductible portion of self-education expenses are A LOT. It’s exactly like the calculations for your tax deductions from work – car and travel, WFH expenses, assets, equipment, etc. – basically, you calculate the tax deductions for your education much like it was another job!

So if you think you’re doing double the work, it’s because you are.

The tax return will definitely be worth it though 😉

I had initially planned to add another type of tax deduction in this article, but gosh, we’ve exceeded 2000 words!

I suppose let’s keep it here for now. Perhaps next year.

Once again, thanks for reading. Don’t forget to read up on your tax deductions for clothing and laundry expenses and work-from-home expenses in part 1 of this article!