Are you a self-proclaimed Wanderlust who wishes you could travel the world for cheap? 🌎

Do you like traveling, but are sick of squeezing into small economy seats and eating cringe-worthy food? ✈️

Are you disciplined with debt and are good at handling finances? 💰

And most importantly, are you willing to work (a little bit) hard, to be able make your travel dreams come true? 🧠

Then my friend, this article is for YOU! 😉

P.S: This post is in no way sponsored by Qantas, and is just me sharing my own experience earning Qantas Points – my friends have been asking for my travel tips!

Table of Contents

What are Qantas Points?

To those who are the noobest of the noobs – Qantas Points are basically reward points you can use with Australia’s Qantas Airlines to purchase a variety of things. These things include hotel stays, products, gift cards, and yes, FLIGHTS! Qantas points can be used to purchase both domestic AND international flights, both with Qantas and their partners. You can also use them to upgrade your flights from economy to premium economy/business/first!

For your reference, here is also a list of flights you can get and how many points they’re worth!

| One-Way Flights

(as of Oct 2022) |

Number of Qantas Points

(Economy / Business / First) |

Lowest AUD Price of Flight (One-Way*)

(as accurate as I could get) |

|---|---|---|

| Sydney – Melbourne | 8,000 / 18,400 | $119 / $999 |

| Sydney – Cairns | 18,000 / 41,500 | $258 / $1,169 |

| Sydney – Bali | 20,300 / 57,000 | $413 / $1,293 |

| Sydney – Singapore | 25,200 / 68,400 / 102,600 | $470 / $2,781 / $3,413 |

| Sydney – Tokyo | 31,500 / 82,000 | $781 / $3,076 |

| Sydney – Dubai | 50,300 / 119,200 / 170,800 | $908 / $4,382 / $8,148 |

| Sydney – London | 55,200 / 144,600 / 216,900 | $862 / $5,864 / $8,622 |

| Sydney – New York | 55,200 / 144,600 | $1,292 / $6,838 / $13,261 |

| Sydney – Paris | 70,200 / 172,900 | $929 / $5,504 |

* The one-way flight prices stated here are based on the cheapest prices I could find on the Qantas website, and are not necessarily the same flight as the ones where you can use your Qantas reward points on (e.g. Qantas rewards seat for a direct flight on Qantas, but cheapest price I could find may be Jetstar-operated flight).

You can also use the Qantas points calculator on their website for any other destinations.

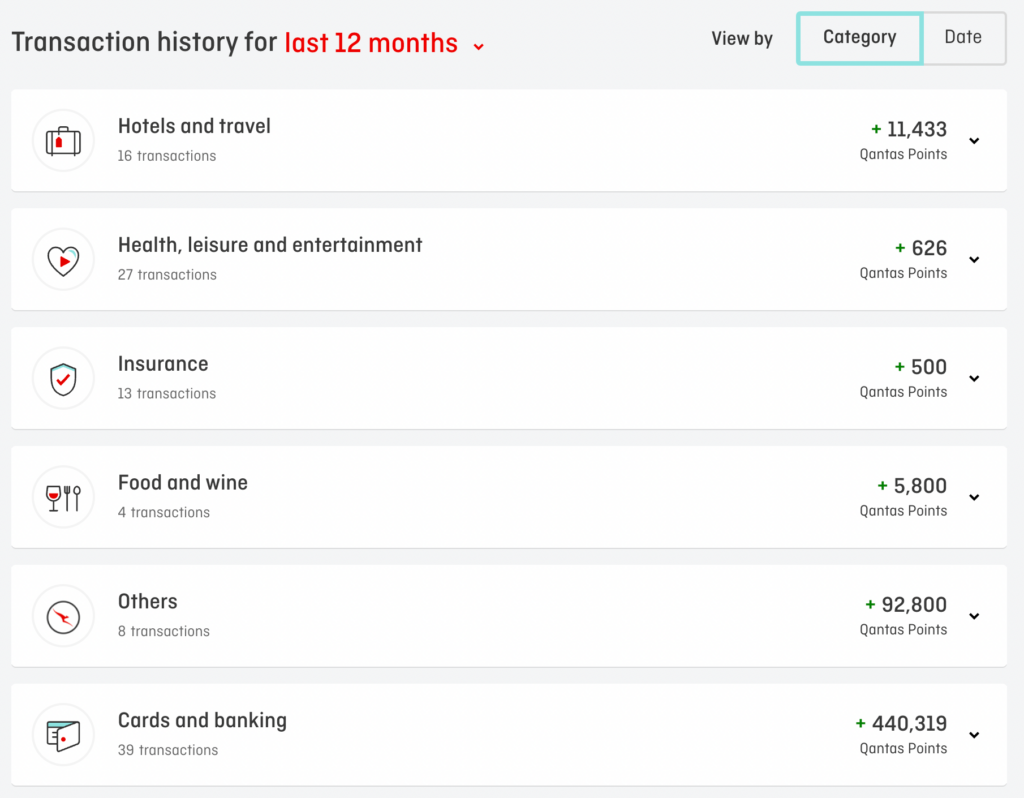

As you can see, my 500,000 Qantas Points can get me pretty much all over the world!

How I’m Earning 500,000 Qantas Points 🥳

Now that I’ve piqued your interest, let’s get right to the juicy part!

First off, there are several ways to earn Qantas points, and those include flying with Qantas, connecting your online shopping to Qantas, buying Qantas Wines, working with Qantas’ partners (e.g. Woolies and BP), and more.

However, my method would be the quickest and most rewarding one.

And that is with CREDIT CARDS!

Earning Qantas Points with Credit Cards 💳

As mentioned earlier, you shouldn’t do this if you can’t be disciplined with money or are bad with keeping track of your finances.

For those who are neither however, Qantas credit cards have the biggest reward for the least amount of effort. A single credit card could potentially earn you 130,000 Qantas points at MINIMUM in exchange for a minimum spend over a period of a few months. 400,000 of my Qantas points were from the bonus points for meeting the minimum spends!

Here are the 5 Qantas Points earning cards I’ve had in the last 12 months:

| Credit Card | Number of Points / Minimum Spend | Annual Fee | My Experience/Review |

|---|---|---|---|

| 1. Westpac Altitude Qantas Black Credit Card

|

120,000 Qantas Points Total = 90,000 Qantas Points when you reach $6,000 in eligible spend on your card within 120 days;

30,000 Qantas Points after making your first eligible purchase on your 2nd year holding the card. |

$295, plus $75 if you opt for Qantas Points | This card was my first Qantas credit card. As a Westpac customer, I got approved on the spot and received my card. Points came as soon as I hit the eligible spend. Kept the card for a year for the extra 30,000 points before cancelling. |

2. ANZ Frequent Flyer Black Credit Card

|

110,000 Qantas Points Total = 110,000 Qantas Points when you reach $5,000 in eligible spend on your card within 3 months from approval. | $425; get $100 refunded back to your card when you hit the $5,000 spend within 3 months. | This was the first Qantas card I applied for but got rejected due to just starting a new job. I found the ANZ CC application process to be the most demanding of all the ones I’ve had. Their requirements include:

I got rejected again without explanation the second time around (after I’d been in my job for over 3 months), but I emailed them to complain and they responded quickly and issued my card after seeing my payslips. Got my points a few weeks after reaching minimum spend – not instantly like than the others. Currently still have the card to keep for a year. |

3. NAB Qantas Rewards Signature Card

|

120,000 Qantas Points Total = 90,000 Qantas Points when you spend $3,000 in 60 days;

30,000 Qantas Points when you keep your card open for over 12 months. |

$295 for the first year; $395 after | My second card and I actually got offered only the Premium Card, which gave me just 70,000 Qantas Points. I kept the card for only 3 months before cancelling (Qantas points came instantly), after which I called their team and was able to get a partial refund of the annual fee!

Highly recommend this one! |

| 4. St George Amplify Qantas Signature Credit Card

|

90,000 Qantas Points Total =

Receive the entire amount once you reach $6,000 eligible spend within 90 days. |

$295 annual fee + $75 annual Qantas program fee | My third card and the one I struggled with the most. $6,000 minimum spend in 90 days was hard to do!

Application process was smooth but had to pick up my card in the branch (usual, if you have never transacted with the bank before). Got the points as soon as I hit the spend requirement, and then closed the card after 6 months but didn’t get a partial refund. |

| 5. CommBank Ultimate Awards Credit Card

|

Update Oct 2023: This card no longer offers bonus points. Commbank has created a new card that offers up to 40,000 Qantas Points.

70,000 Qantas Points Total = Receive the entire amount upon reaching $5,000 minimum spend in 90 days |

$0-35/month;

$0 if you spend $2,500 in the month and opt to receive online statements |

Applied for the card and got accepted! Now just waiting for it to arrive. This will lead me to reaching 500,000 Qantas Points in a year through credit cards alone! |

Note: Updated as of 31 October 2023

The five credit cards above are the ones that I personally have experience dealing with, however, there are several others that Qantas has listed in their page of Qantas Points earning credit cards.

The American Express and Qantas Premier credit cards have very good reviews as well, however I could not be accepted for them due to my visa status (only Australian Citizens and Permanent Residents are allowed to have them).

And now that you know how I’m on track for 500,000 Qantas Points, let’s move on to the how-to!

P.S. Yes, you can still get these credit cards even when you’re on a visa! For reference, I’m on a Temporary Graduate Visa (subclass 485).

The Process of Credit Card Churning 💳

Credit card churning is the process of applying for a credit card for the sole purpose of receiving the sign-up bonus, and then cancelling the credit card soon after you receive the bonus.

How do I apply and get accepted for a Qantas Points earning credit card?

Applying for a Qanats credit card is the same as applying for any other credit card. You may do so online, and they generally require you to state your income and provide payslips as proof. The bank may then either mail the card to you or require you to collect it in branch.

It is important to note that banks are hesitant to offer you a credit card if they see that you have many accounts open, as this might mean that you have trouble paying them off.

I was able to be accepted for five credit cards in a year because I paid off my entire balance and then closed my cards as soon as I received my bonus Qantas points. Banks may also not like that, but they don’t look at that during the application process.

Will all the credit card applications affect my credit score?

A lot of people are worried of the impact of credit card applications to their credit score, especially if they are about to require a bigger loan such as a mortgage or car loan.

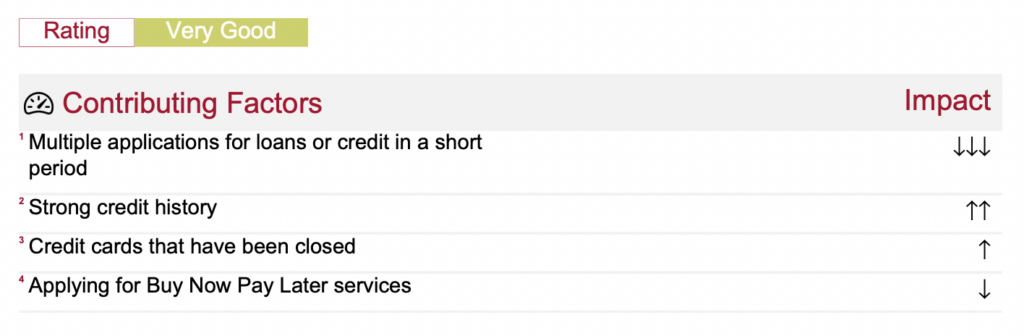

To ease your worries, my credit score has actually gone up since I started churning credit cards.

Before I started with my card churning journey, I only had a “Average” credit rating – my first 3 credit card applications were all rejections because I applied for Qantas credit cards when I was still a student (couldn’t take the first 2 no’s as an answer 😂).

As you can see from my report, having multiple applications for credit cards has a large negative impact on your credit score. However, I actually believe that my paying off of all my balances on time and closing my accounts have had a stronger positive impact that more than offsets the negative of having multiple applications.

I’ve kept track of my credit rating through the months, and I had moved from “Average” to “Good” when I had closed off a credit card for the first time. Currently, I’m now in “Very Good” territory after having closed off 3 cards and consistently paying off my cards in full each month.

How do I meet the credit card minimum spend?

First off, congratulations on your getting your Qantas credit card!

Meeting the eligible spend for the bonus points is tricky – it’s important to remember that banks generally do not count payments to government (e.g. ATO), cash advances, credit card fees, and balance transfers in the eligible spend.

My techniques for meeting the minimum eligible spend include:

- Paying for dinners out with friends/family and getting them to transfer me

- Waiting till I’ve received my credit card to make a big purchase

- Buying grocery gift cards (to use later!) when I only have a few days left to spend

- Paying everything off with Zip (buy now, pay later) when waiting for my new credit card to arrive, then paying that entire balance off when I receive it

- Paying government payments or BPAY payments on Zip (yes, I love Zip and this isn’t even sponsored) and then paying Zip off with credit card (this turns it into an eligible spend!)

And many more! You just have to be creative.

How many credit cards can I have at once?

I generally make it my own personal policy to have a maximum of 2 at a time. This allows me to keep better track of my payment deadlines and to meet the minimum spend more easily.

I have had 3 at once, and I almost got rejected for the 3rd one (ANZ) when I already had the other two. As I had mentioned, it is harder to get accepted for a new credit card if the bank sees that you already have several open accounts.

How often can I apply for a new credit card?

A logical person would say to be conservative and do twice a year at most, but I am living proof that you can apply for and get accepted for at least 5 different credit cards in one year! 😂 I generally had 2-3 months in between card applications, and would wait a few weeks after cancelling one before applying for a new one.

I won’t promise you the same for yourself, but from my own research, a credit card application is worth 5 points on your credit report (disclaimer: my own research is not universal truth).

Additional Information about Qantas Points Credit Cards

I couldn’t fit this in any other section, but it’s extremely important for you to remember that you can generally only get the bonus Qantas points if:

- The bonus points offer is on at the time you apply (usually it is),

- You do not hold any of the bank’s other Qantas credit cards,

- and you have not closed a Qantas card from that bank in the last 12 months.

For example, if you’ve held a Westpac Black Qantas card and closed it on 11th October, you won’t be able to reapply and receive the bonus Qantas points again until you do so after 11th October 2023.

Some companies definitely have more requirements, such as ANZ’s T&C’s below:

Offer not available where you currently hold an ANZ Frequent Flyer, ANZ Frequent Flyer Platinum or ANZ Frequent Flyer Black credit card, or have closed, or qualified for bonus Qantas Points or a credit back on, any of those ANZ Frequent Flyer credit cards within the previous 12 months.

As such, it is extremely important for you to read through the T&C’s of the card as well.

P.S. this also means that you can do your credit card churning pretty much every 12 months! 🙊

Anyways, I’ll end it here for now. Feel free to shoot me a message for any questions, or leave a comment below. Thank you for reading!

5 Comments

Excellent blog here! Also your site loads up very fast!

What host are you using? Can I get your affiliate link to your

host? I wish my website loaded up as quickly as yours lol

my site … boda8

Good information. Lucky me I discovered your site by chance (stumbleupon).

I have bookmarked it for later!

Also visit my web blog: บาคาร่าauto

Hello I am so delighted I found your blog, I really

found you by accident, while I was browsing on Google for something else, Nonetheless I am here now and would

just like to say thanks a lot for a incredible post and a

all round exciting blog (I also love the theme/design), I don’t have time to browse it all at the minute but I have book-marked it and also included your RSS feeds,

so when I have time I will be back to read much more, Please do keep up the excellent

job.

Wonderful post! We will be linking to this great post on our website.

Keep up the great writing.

My homepage – รับออกแบบโลโก้

You should be a part of a contest for one of the greatest websites online.

I will highly recommend this blog!

My web-site: บาคาร่าเว็บตรง