*Alarm rings*

Time to wake up…. It’s tax time!

To some, tax time means a good thing – hefty income tax returns and a bit more money to blow on drinks; to others, it’s more of “sigh, there goes my emergency fund”.

This article focuses on explaining the taxation formula, more specifically, helping you understand how to calculate your tax-assessable income. I’ll also be debunking some MYTHs that have apparently been going around!

Also, if you have a sole proprietorship business that is GST-registered (goods and services tax), I suggest you pick up your phone and call a tax accountant because GST is quite complicated to explain. Likewise, if you own trusts, earn income from another country, share joint ownership with someone on anything that earns you money (e.g. property or shares), receive fringe benefits or anything complex…. Please read this article through to the end AND THEN call your accountant.

The people who can make the most use of this article are simple noobs (my favorite) who earn an income from being employed in one or two jobs in Australia, invest in Australian stocks, and at the max, have a small side business based in Australia.

Table of Contents

Disclaimer: Everything written here is general information taken from Australian taxation legislation and is not meant to be financial advice. Taxation is a complicated topic that usually requires examination on a case-to-case basis, and if you have any confusion whatsoever, please consult a registered tax agent.

How is income tax calculated?

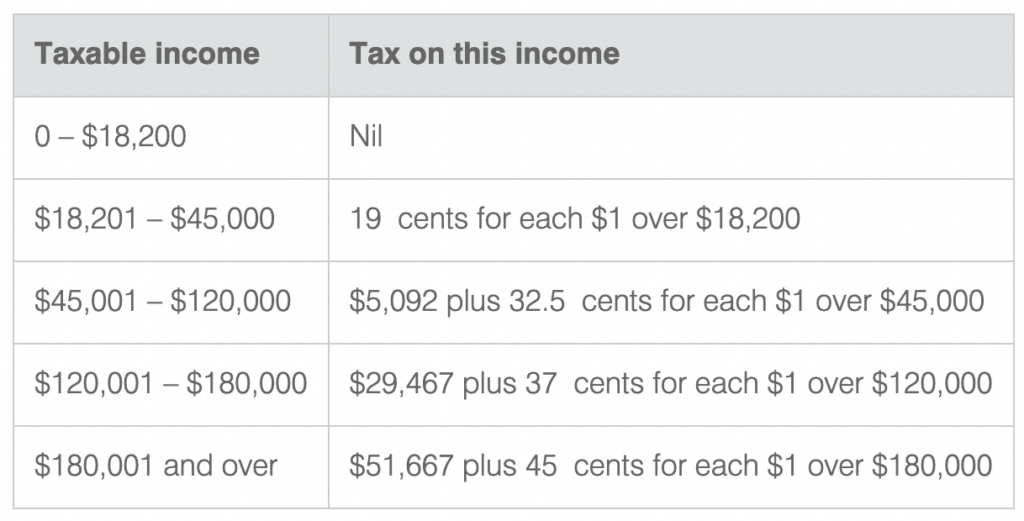

Before we dig deep into the taxation formula, below are the 2021-2022 income tax rates released by the ATO.

As you can see, the higher your income, the more tax you pay – every dollar you earn over $180,000 is taxed at a hefty 45% (45c per $1), and for most commoners, you are probably in the $45k-$120k bracket, which means your marginal tax rate is 32.5%. This doesn’t even include the Medicare Levy which is an extra 2% of your annual income… much pain, I know!

Australia’s average taxable income is approximately $62,500 – which means tax payable is

$5,092 (as stated in the table)

+ [$62500-$45000]*0.325 (32.5 cents per $1 over $45,000)

= $10,779.50

PLUS Medicare Levy of $1,250 (62,500*0.02).

For a total of $12,029.50 of taxes!!!

Imagine working so hard and going home with less than $50k for yourself for the whole year!

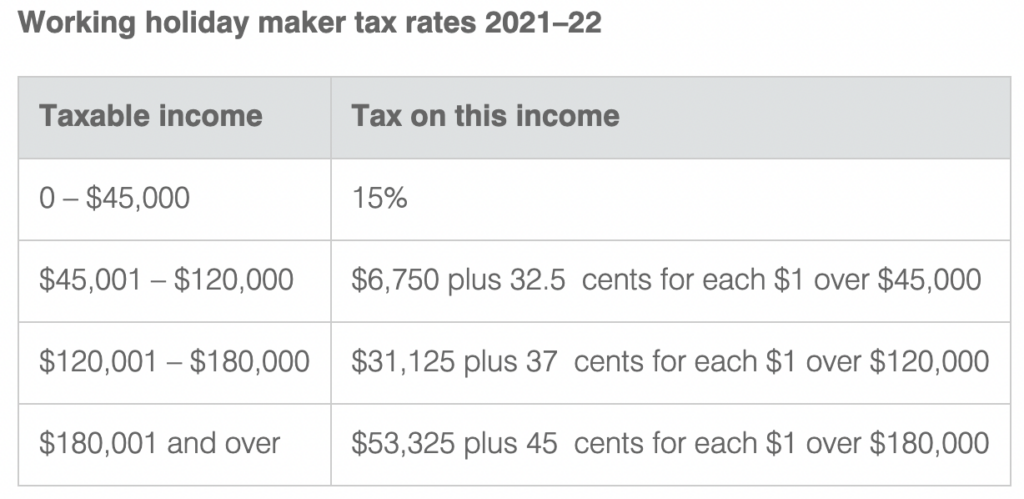

EXTRA NOTE: People on Working Holiday visas have a different set of tax rates. Same with people who are not an Australian resident for tax purposes (which means that you pay tax on the income you earn in Australia, in another country). You guys generally have to pay higher taxes!

How much income tax do I have to pay?!

Now that you know the Australian tax rates and how to use them, the most important part is finding out how much tax you actually have to pay. Unfortunately, it’s not as simple as just knowing the tax rate.

In Australia, the tax formula is:

Tax to pay = (Taxable income * income tax rate) – Tax offsets

AND

Taxable income = Assessable income – Deductions

It sounds complex, but I WILL BREAK IT DOWN FOR YOU.

Taxable income is how much of your income is subject to the tax rates.

Assessable income is what the ATO considers as your “income”.

Deductions are what you can deduct from your assessable income (thereby making your taxable income lower!).

Lastly, Tax offsets are the direct amount deductions from how much tax you pay (note: this is different from deductions).

To get you excited, finding out about all your eligible deductions and tax offsets allow you to pay LESS TAX AND LESS MEDICARE LEVY. There are so many deductions and offsets available that the majority of people have no idea about, including deductions of clothing, travel, and work-from-home expenses, and tax offsets for low and middle income earners, seniors, if you have private health insurance, etc.

I’ll be covering them below!

Assessable income

A simple way to describe Assessable income is, it is the amount you earn from working. Tax people would all know that there is muuuccchhhh more to that description, but hey, I’m here to help make things simple!

If you have 1 job that earns you $60k a year before tax, then you have $60k as Assessable income. If you have a second or even third job that adds an extra $20k a year, then your Assessable income would be $80k.

Easy peasy, right?

Aside from your paycheck from full-time, part-time, or casual work, these are other common things that constitute assessable income:

-

Investment income

If you bought and sold stocks for the purpose trying to get profit, and they form part of your income tax calculations (they could be part of a different taxation process too, called Capital Gains… check this article from the ATO to find out which one yours fall under), and say you profited $5k in the year with a salary of 60k – this 5k would make your assessable income 65k. Likewise, if you lost money from selling stocks for the purpose of profit, you subtract that amount from your Assessable income. Please note that this is only is you are a stock trader and not a stock investor.

Income from dividends and income from your interest in your savings account also form part of your assessable income.

2. Income from your side business

If you have a side business of being an independent contractor such as being a model or a website developer, have an ABN, and receive income from giving your services, you also have to include that in the calculation of your Assessable income. If you own a rental property (are you really a commoner!?) and earn rental income, this should also be included in your Assessable income.

Generally, any income you earn from a side hustle (that you do NOT consider as simply a hobby – read this article from the ATO for more details), forms part of your assessable income.

3. Other miscellaneous income

Naturally, as you earn more income from different sources, or get other benefits from your employer such as a car, a laptop, accommodation (which are called Fringe Benefits), the calculation of Assessable Income gets more complicated and may require the help of a tax accountant. For most people however, assessable income calculation should be pretty straightforward.

Deductions

Based on the tax formula, deductions DIRECTLY reduce the Assessable income. But what do deductions even mean?

If you have been paying attention so far, Assessable income is the monetary value of how much you earn from doing work. With our government being fair and awesome, they created the concept of “deductions”. Deductions are the monetary value of everything you expend for the purpose of earning your Assessable income. In noob-y terms – because you pay tax on the money you make, you deserve to deduct the expenses you pay for towards being able to make that money. See, how nice of the ATO!

Deductions deserve a separate article of their own, which for now I will link to the ATO’s website, but the most commonly used are clothing expenses (if you have to buy a uniform for example!), Asset expenses (if you have to buy tools such as a tool box for tradies, or salon products if you offer beauty services), and Covid-relevant work-from-home expenses (computer, internet, etc.).

Being able to calculate how much deductions you have could potentially save you hundreds or even thousands of dollars, so I highly suggest reading this article on tax deductions. I have personally saved thousands just by knowing what deductions I can include.

Offsets

Lastly, income tax offsets directly deduct from the amount of tax you pay. The government gives tax offsets mostly to lessen the burden of tax on low to middle income earners.

To illustrate the difference between deductions and offsets, say you have a $60,000 assessable income. Thanks to the lessons you learned from this blog, you found that you have total deductions of $10,000. This makes your taxable income become $50,000 (assessable income – deductions). You then calculate the tax on your taxable income, which is:

Tax to pay =

$5,092 (once again, refer to tax table) + [$50000-$45000]*0.325 (32.5 cents per $1 over $45,000)

Tax to pay = $6,717.00

Now, for example, the ATO has a tax offset of $500 for anyone with a taxable income below $55,000. This means that instead of having to pay $6,717 to the ATO, your tax offset of $500 would mean that you only have to pay $6,217.

Tax offsets are often instantly calculated by the ATO website when you lodge your tax returns (do you now realize why you always get a refund?), but it is still important to be familiar with the different tax offsets that exist. This article is where I get into detail.

Woohoo, you adulted and understand taxes now!

If you’re still here, whew! Give yourself a pat in the back for working to understand how your taxes work. And if you still require more help, don’t forget that tax agents exist to make your life much better.

3 Comments

Wow! Thanks for this article, won’t need to pay my accountant for simple tax returns anymore

Nice 🙂

Everything is very open with a really clear clarification of the issues. It was definitely informative. Your site is extremely helpful. Many thanks for sharing!