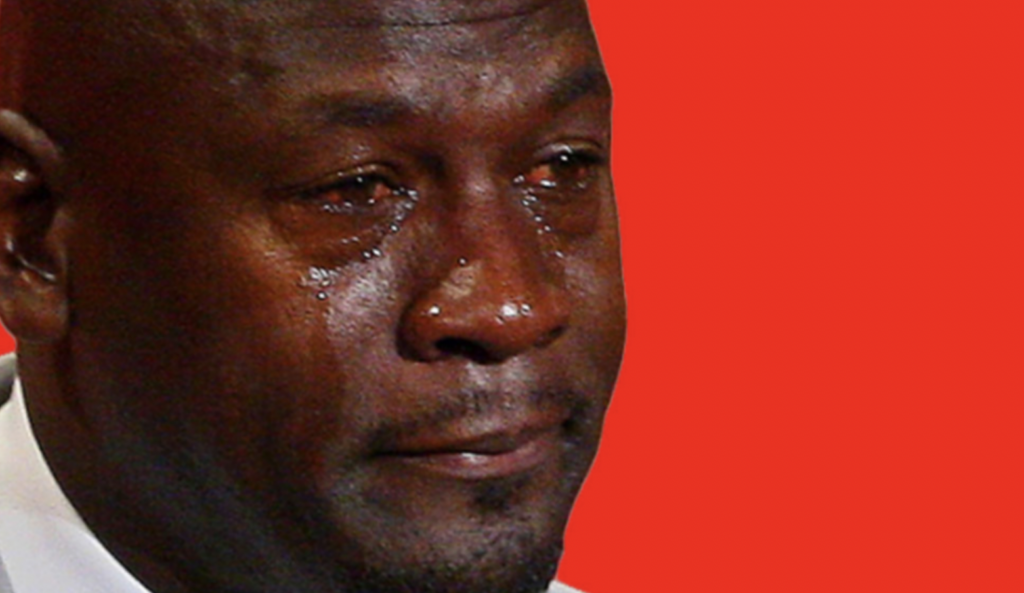

Okay friends, let’s be real – you’re here because you’ve just experienced a sad loss of a few hundred (or a few thousands if you’re Richie Rich), and you’re wanting to learn how to deal with the emotional and mental consequences. I, myself, have lost AU$1,000 in a day due to a misunderstanding with my settlement dates (story for another day), and I know HOW GUTTED you must be feeling right now. In fact, I’m writing this article to make myself feel better too. I’m not gonna sugar coat it… selling at a loss sucks.

However, let me tell you, CONGRATULATIONS!

You have popped your loss cherry and are now on the road to better trading.

You probably already know all this, but for the sake of soothing your sad soul, let me write these all down for you:

-

Loss is sometimes necessary for future gain

One of my first investments in the ASX was with one of the big 4 Australian banks. At the time, I was unfamiliar with them and invested about $4,000 because their share price had gone down sharply and I expected a big company’s stock to go back up. Before I knew it, they were slammed with a scandal, and the price dipped to levels that caused it to be red in my portfolio for over a year.

I only recently decided to get rid of it because I found better stocks to invest my money in. I sold it for a loss of around $700 (17.5% loss), which naturally at the time, was extremely stressful for me to do. I then used the money to take part in another company’s share purchase offering.

Within a month, the $3000+ I put into the share purchase gained over 150%. The stock I invested in released extremely positive annual reports alongside plans for expansion into the US. I gained back my $700, with so much more on top of it. I then used the profit from that to invest in cryptocurrency, an Amazon business, a bottle of Blue Label (yes, I’m a whiskey person), and a new pair of Nike Air Forces.

Sometimes in stocks and in life, cutting losses is the best thing you can do for yourself.

Even if it hurts in the short-term.

2. Money can be re-earned but experience is forever

If I were to calculate how much money I’ve actually lost due to bad investments and stop-losses from day/swing trading… I’d honestly be able to buy a beautiful Toyota 86!

On the flip side, the experience and knowledge I gained from all these losses actually DID allow for me to buy a Toyota 86, furniture for my new apartment, and my whiskey collection (Johnnie Walker, anyone?). Not only that, I’m able to provide my family and friends advice with their investments, write this blog, and graduate from being a finance noob to a finance nerd!

Sure, every $ you lose hurts you. But that is the price we pay for knowledge. I like to think of my losses as how much I pay the real world to teach me some unforgettable lessons. For someone with decades left of life (I hope the same for you, my friend), a 10% gain for every 5% loss adds up and could become worth millions of dollars.

3. No one, NO ONE, can trade and ONLY profit

Not even the greatest investor in the world! I don’t think I even have to say any more here. Warren Buffett, Benjamin Graham, Ray Dalio… they’ve all talked about loss at one point. Profit and loss go hand-in-hand, just like success and failure. You just have to accept that it is a fact that taking risks to earn more money means a chance to lose money as well.

Remember that the strongest people are not those who always succeed, but those who always keep trying despite numerous failures.

Ultimately, the greatest thing we can do as humans is to move on and learn from our losses. If your loss was due to a mistake – take steps to not do it again. If it was due to the economy dying – remember that the whole market died with your stocks (and you).

You saw a chance, took a risk, and failed… be proud you had the guts to take a plunge in the first place!

8 Comments

Very nice write-up. I definitely appreciate this site. Thanks!

I must thank you for the efforts youve put in penning this site. I am hoping to check out the same high-grade blog posts by you in the future as well. In fact, your creative writing abilities has motivated me to get my very own blog now 😉

Thanks for your blog, nice to read. Do not stop.

Greetings! Very useful advice in this particular article! Its the little changes that will make the biggest changes. Thanks for sharing!

Nice post. I learn something totally new and challenging on websites

I really like reading through a post that can make men and women think. Also, thank you for allowing me to comment!

I just like the helpful information you provide in your articles

This was beautiful Admin. Thank you for your reflections.