Why is Warren Buffett so rich and famous?

As I had mentioned in my previous article on stock investing, value investing means buying a stock at a good price in relation to its value as a company. The stock price of a company can be classified as either being undervalued, overvalued, or fairly valued, and the concept of value investing means buying stocks that are considered to be undervalued.

The philosophy behind this style of investing is used by the likes of Warren Buffet and several other professional investors, and involves a lot of financial research. I’m writing this article in the hopes of simplifying the steps of value investing for my beloved finance commoners.

Table of Contents

1. Pick a good company

Firstly, you can never get any good value from a sh*t (excuse my language) company. While this seems obvious, people’s emotions or lack of research sometimes leads to the worst decisions. Amazon was $300 in 2015, and Gamestop was $300 in January. Both had the same stock price, however, Amazon was a growing and profitable company at the time, while Gamestop is currently struggling to compete with online competitors.

By buying either stock at $300, your Amazon share would be worth $3,000 now, and your Gamestop share worth $180 (as of November 2021). I know the time horizons are quite different, but I hope you see what I’m trying to say here. Plus, would you ever see Warren Buffet investing on meme stocks?

The first and most obvious step in value investing is to pick a good company. I like to simplify it into a very memorable acronym: SRP – sustainable, reputable, profitable. A company that ticks the SRP box will undoubtedly do well. There is a reason Amazon, Facebook, and Google shares have soared through the years – and it’s pretty common sense why (i.e. sustainable, reputable, and profitable).

You don’t have to think too hard, just look into the companies that first pop into your mind when you think of these three traits. In Australia, some of my favorites are JB-Hifi and Wesfarmers. I also recommend reading up on smaller companies, as some may be hidden gems.

By the way, these companies are also, in the very little chance they become insolvent, the ones that have the highest probability of returning your capital to you.

2. Do some research on their stock price

Once you have picked a company and are interested in investing, research on whether their stock price has good value. While experts like Buffett can make calculations on their own, it would be very difficult for individuals to do them without the proper financial training. However, several valuation companies exist such as Goldman Sachs and Morningstar that release their statements on whether the stock is over or underpriced. Their analyses would be good bases to see whether the stock may be a good one for you to invest in.

Check the historical charts and see how high or low it’s trading right now compared to the past. You could easily access all these data and graphs on your trading platform or even on a quick Google search.

If you want to go the extra mile and look at some valuations yourself, I highly recommend Simply Wall St. It’s a platform that I personally use for my own research, and I find the charts and infographics extremely helpful.

3. Differentiate between investment and speculation

Do you guys know about the 2000 Dotcom bubble and the 2008 housing bubble? Or do you at least remember how they screwed up the economy BIG TIME? Whether you do or not, let me tell you the tl;dr version why they both ruined the economy – people went over their heads putting their money in tech (for the Dotcom bubble) and in real estate (for the housing bubble) without any real basis for either; leading to SIGNIFICANT losses when the bubbles finally burst.

Let me explain the Dotcom bubble for you more specifically to illustrate (the housing bubble happened in a very similar way):

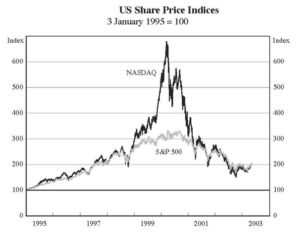

From 1995-2000, when the internet was just in its starting stages, lots of new companies were popping up here and there and asking for funding by going public. Individuals and companies were so excited about the internet, that total investments into any company that had “.com” had risen by over 500% in the span of 5 years, even when some of these companies hadn’t even made profit yet or barely had anything in their balance sheets. Investors simply put in money due to the excitement surrounding the internet and potential of it, and also because they wanted to ride the wave and try to profit from all the Dotcom stocks going up.

Naturally, reality had to take its course – and by 2001, the bubble finally burst when the tech companies couldn’t offer a return to its investors and investors borrowed too much for investment and couldn’t pay back their debts. NASDAQ (the tech index) crashed by almost 80% (an investor with $1,000,000 would have lost $800,000).

These events are why I want you to understand the difference between investment and speculation. Investment means that the asset you are investing in and the price you’re paying – actually MAKES SENSE. It’s extremely simple logic when our emotions don’t play a part (even when the stock market is a very emotional game). Invest in value, not in your or the market’s excitement. Or if you really want to ride the trend and gain a bit, do so very carefully and set a stop-loss.

The crash took the NASDAQ 15 years to recover, by the way.

With this, I hope you now understand why value investing works. It’s an investing style that has passed the test of time, and is sworn by by not only Warren Buffett, but also several other successful investing professionals.

Thank you for reading this article, and I hope you can take something away from it.

On a very related note, please read through my article on your 3 basic steps to stock investing, which will hopefully give you tips on improving your stock market research.